When you send Bitcoin from Binance to a wallet on Coinbase, you might think it’s just a simple transfer. But behind the scenes, a complex web of rules is checking your name, address, and transaction history. That’s the FATF Travel Rule in action - and it’s changing how crypto works for everyone. Since early 2025, these rules have become mandatory across most major economies, forcing exchanges, wallets, and even DeFi platforms to act like banks. If you’re using crypto seriously, you need to understand what’s required - and why it matters.

What Exactly Is a VASP?

You hear the term VASP everywhere now - Virtual Asset Service Provider. But what does it actually mean? FATF defines it clearly: any person or company that runs a business involving virtual assets. That includes exchanges, custodial wallets, crypto ATMs, and even some DeFi platforms. If you’re buying, selling, sending, or storing crypto for others, you’re likely a VASP.

The five core activities that make you a VASP are: exchanging crypto for fiat money, swapping one crypto for another, transferring crypto between users, holding crypto on behalf of others, and helping with token sales. It doesn’t matter if you’re a startup in Lagos or a giant in Singapore - if you do any of these as a business, you’re regulated.

This definition caught many off guard. Some thought only big exchanges would be affected. But now, even decentralized protocols with a founder who can update code or freeze funds are being classified as VASPs. FATF’s 2025 update made it clear: if someone has control - even partial - over the system, they’re responsible. That’s why only about 12% of DeFi projects are truly exempt under current guidance.

The Travel Rule: What You Must Send With Every Transfer

The Travel Rule isn’t a suggestion. It’s the core of FATF’s crypto crackdown. Since 2020, it’s been slowly rolling out. By January 2026, 73% of countries have made it law. And it’s simple: if you send more than $1,000 in crypto, you must send identifying info with it.

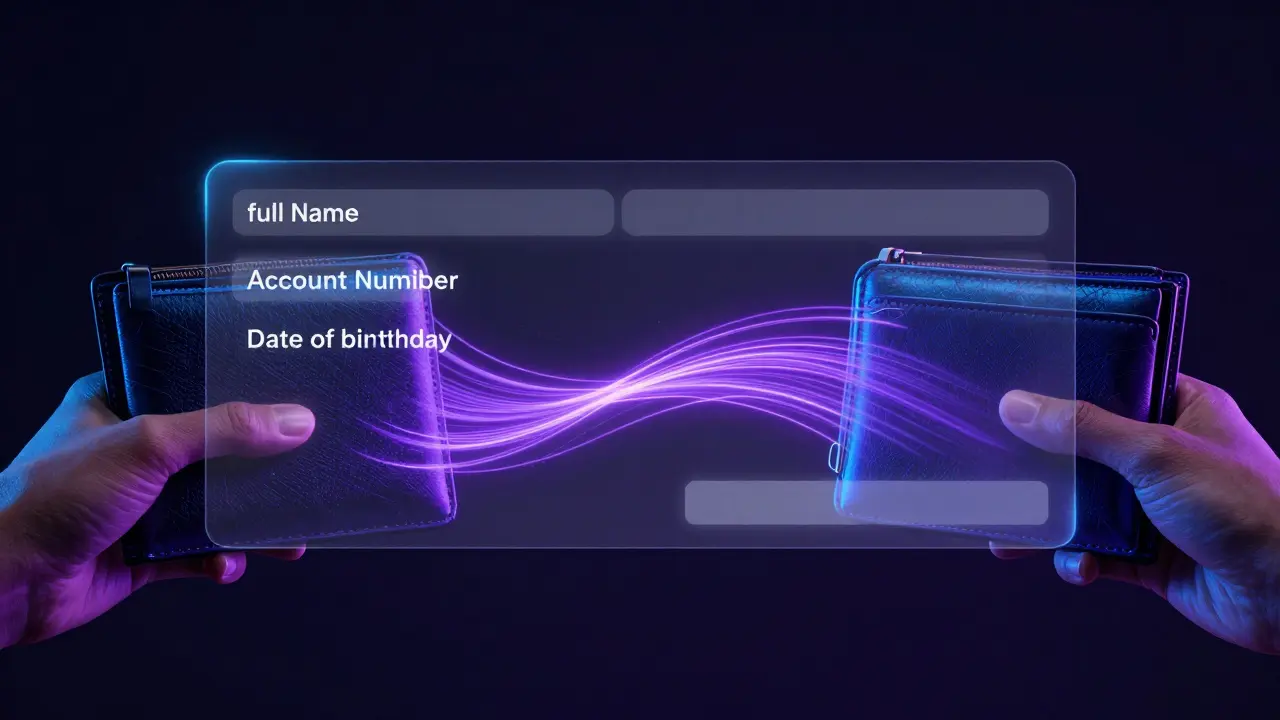

For the sender (originator), you need: full name, account number, and either a physical address or date of birth. For the receiver (beneficiary), you need their name and account number. No exceptions. This is the same as wire transfers between banks. The goal? To stop criminals from hiding behind pseudonyms.

Here’s the catch: not every country uses $1,000. Japan uses ¥100,000 (about $650). The EU, US, and UK mostly stick to $1,000. But 68 countries, including Australia and Canada, raised the threshold to $3,000 to reduce friction for everyday users. That means if you’re sending crypto internationally, you might hit different rules depending on who you’re sending to.

And it’s not just about sending. VASPs must also check the info they receive. If the sender’s details are missing or look fake, the receiver must block the transaction. That’s why you sometimes see transfers stuck in limbo - your exchange is waiting for the other side to send clean data.

How VASPs Are Meeting the Rule - and Struggling

Compliance isn’t plug-and-play. It’s expensive, messy, and technical. Crypto.com spent $4.2 million and 18 months to get compliant across 47 countries. Monthly costs? $185,000. Smaller exchanges? Many are shutting down or merging just to survive.

Why so hard? Because there are 14 different technical protocols in use worldwide. One exchange might use the Travel Rule Protocol (TRP), another uses the InterVASP Messaging Standard, and a third uses a custom API. None talk to each other perfectly. A VASP in Germany might reject a transaction from a VASP in Brazil because their data formats don’t match.

That’s where tools like TrustChain and VerifyVASP come in. They act as bridges - storing VASP identities, validating data, and translating formats. TrustChain has a 4.1/5 rating for reliability, but users say the setup is a nightmare. VerifyVASP has a good database of registered providers but flags too many false positives, blocking legitimate transfers.

And training? Chainalysis says compliance teams need 87 hours of specialized training just to get started. Most crypto companies didn’t hire lawyers or AML experts - they hired devs. Now they’re scrambling to upskill.

DeFi, Stablecoins, and Self-Hosted Wallets: The Gray Areas

DeFi was supposed to be the escape hatch from regulation. But FATF’s 2025 update shut that door. If a DeFi protocol has a team that can change parameters, upgrade contracts, or freeze funds - it’s a VASP. Even if it’s “decentralized,” if a person or group holds influence, they’re on the hook.

That’s why most DeFi apps now require users to connect through a regulated gateway. You can’t send ETH directly from your MetaMask to a lending protocol anymore without going through a VASP first. Some projects are trying to restructure as non-custodial tools with no control - but that’s rare.

Stablecoins are treated like digital cash. The EU’s MiCA regulation, in effect since June 2024, requires stablecoin issuers to hold reserves, disclose audits, and comply with Travel Rule rules. The US is expected to follow with a new report in mid-2026, likely splitting oversight between the SEC and banking regulators.

Self-hosted wallets (like MetaMask or Ledger) are still a blind spot. FATF says VASPs must apply enhanced due diligence when transacting with them. That means if you send $2,000 from Coinbase to your own wallet, Coinbase must flag it, review your history, and possibly ask for proof of ownership. Some exchanges now block large transfers to non-custodial wallets unless you complete extra verification.

Global Patchwork: Who’s Compliant, Who’s Not

FATF has 207 member countries. But compliance isn’t universal. As of January 2026:

- 42 countries have fully implemented the Travel Rule

- 28 are scheduled to implement by end of 2026

- 17 are still in development

Switzerland’s FINMA is praised for clear, flexible rules. Brazil’s COAF? Users rate it 2.3/5 for being confusing and inconsistent. The US uses FinCEN’s 2020 guidance, which is strict but technically detailed. The EU uses the Transfer of Funds Regulation (TFR), which adds extra checks for cross-border transfers.

That patchwork creates real problems. A crypto business in the UK can’t easily serve clients in Nigeria or Argentina if those countries haven’t built the infrastructure. That’s why global crypto adoption is still uneven - it’s not about tech, it’s about regulation.

Non-compliant countries risk being “gray listed” by FATF starting in Q3 2026. That means banks worldwide will avoid doing business with them. It’s a financial embargo - and it’s coming.

What This Means for You

If you’re an individual user: expect more steps when sending crypto. You might need to verify your address again. Large transfers could take longer. Some wallets will block you unless you use a compliant service.

If you run a crypto business: compliance is no longer optional. You need legal counsel, a compliance officer, and a tech solution that works across borders. The cost is high, but the cost of non-compliance is higher - fines, license revocation, or worse.

If you’re into DeFi or self-custody: your freedom is shrinking. You can still use non-custodial wallets, but the path to using them with real-world services is getting narrower. The future of crypto isn’t just about code - it’s about paperwork.

Still, there’s a silver lining. With better tracking, stolen crypto is being recovered at rates of 45-60% - up from 15-20% before. Law enforcement can now trace ransomware payments and fraud. That’s good for honest users. It means less scamming, less theft, and more trust.

By 2027, 92% of global crypto transactions will happen under full Travel Rule compliance. The system won’t be perfect. But it’s becoming unavoidable. The question isn’t whether you’ll adapt - it’s how fast you can.

Is the FATF Travel Rule mandatory for all crypto transactions?

No - only for transfers above $1,000 (or local equivalent). Smaller transactions are exempt, though some countries like Japan set lower thresholds. The rule applies only when both parties are VASPs - not when sending directly from one personal wallet to another. But if you use an exchange or custodial wallet, the rule kicks in automatically.

What happens if a VASP doesn’t comply with FATF rules?

Non-compliant VASPs face severe consequences: license revocation, heavy fines, bank account closures, and being cut off from the global financial system. Countries that don’t implement the rules risk being gray-listed by FATF, which makes international banking nearly impossible. In 2025, two major exchanges in Southeast Asia were shut down for failing to collect originator data - their founders were personally fined.

Can I avoid the Travel Rule by using a non-custodial wallet?

You can send crypto directly between personal wallets without triggering the rule - but only if you never use a VASP. If you buy crypto on Binance, then send it to your Ledger, that initial purchase triggered the rule. If you later send from your Ledger to another VASP, that VASP must apply enhanced checks. You can’t fully escape the system unless you never interact with regulated entities.

Do DeFi protocols have to follow the Travel Rule?

Yes - if they have any controlling entity. FATF says most DeFi platforms still have teams that can change code, pause contracts, or access funds. That makes them VASPs. Truly decentralized protocols without any human control may be exempt, but these are rare. Most DeFi apps now require users to go through a compliant gateway to access them, effectively applying the rule indirectly.

What’s the difference between FATF guidance and local laws like MiCA or FinCEN?

FATF sets the global standard - it’s a recommendation. Countries turn it into law. The EU’s MiCA and TFR add more detail: mandatory reserve audits for stablecoins, stricter rules for unhosted wallets, and mandatory reporting to EU financial intelligence units. FinCEN’s rules in the US are more technical, focusing on data format and transmission protocols. So while FATF says “collect this info,” local laws say “how to collect it, when to report it, and what penalties apply.”

Will FATF’s rules kill crypto innovation?

Some say yes - especially for DeFi and micropayments. Others say no - compliance brings legitimacy. Banks and institutional investors won’t touch crypto without clear rules. The real risk isn’t innovation dying - it’s innovation being pushed to unregulated jurisdictions where scams thrive. The most successful crypto projects now are the ones building compliance in from day one, not fighting it later.

How do I know if my crypto wallet or exchange is FATF-compliant?

Look for clear statements on their website about AML/KYC policies and Travel Rule compliance. Check if they mention FATF, VASP registration, or data transmission protocols. Major exchanges like Coinbase, Kraken, and Binance list their compliance status publicly. If they don’t mention it, assume they’re not compliant - and avoid large transfers until they do.

What’s Next for Crypto Regulation?

The next big shift is the OECD’s Crypto-Asset Reporting Framework (CARF), starting in October 2027. It will require VASPs to report transaction data directly to tax authorities - similar to how banks report interest. This isn’t just about crime - it’s about taxes.

Meanwhile, the market for compliance tech is exploding. It was worth $2.14 billion in 2025. By 2028, it’s projected to hit $4.87 billion. Chainalysis, Elliptic, and CipherTrace dominate, but new players are entering with AI-driven transaction monitoring and blockchain analytics tools.

One thing is clear: crypto is no longer a wild frontier. It’s part of the global financial system - and it’s being regulated like one. The tools, rules, and costs are here to stay. The question isn’t whether regulation will win - it’s whether you’ll adapt before it forces your hand.

Comments (14)

Scott Perlman January 16 2026

Honestly? This is just the internet becoming banking. We knew it was coming. Just keep your keys safe and move on.mark nine January 18 2026

The travel rule is just KYC with extra steps. You think crypto was ever anonymous? Nah. It was just poorly tracked. Now it's just tracked properly.Michael Thomas January 19 2026

If you can't handle paperwork, don't touch crypto. This isn't a conspiracy. It's called law.Sandi Johnson January 19 2026

So we're turning Bitcoin into a bank transfer with extra steps. Brilliant. The blockchain was supposed to be the escape hatch. Now it's just a fancy wire transfer.Karl Fisher January 20 2026

Darling, let's be real - this isn't regulation. It's the last gasp of a financial system terrified of its own obsolescence. I mean, imagine paying $185k/month just to send ETH. It's not compliance, it's performance art. And the VASP protocols? Honey, they're like 14 different dialects of broken Esperanto. No wonder transactions get stuck. It's not the tech. It's the ego.Jen Kay January 20 2026

I get the frustration, but let's not pretend this is all about control. The fact that stolen crypto is being recovered at 60% now? That's real value. We're trading a little friction for actual safety. It's not perfect, but it's progress.Eva Monhaut January 21 2026

I’ve watched this unfold from Lagos to LA, and what’s fascinating is how the same tech that promised freedom is now being shaped by the very institutions it tried to replace. The irony is delicious - but the outcome? More people are protected. More scams are blocked. More honest users can sleep at night. It’s not the crypto utopia we dreamed of, but maybe it’s the one we needed.Buddy Faith January 22 2026

They're calling it compliance but its just a backdoor to track every coin you ever touched. You think your ledger is safe? Theyre watching. Every wallet. Every swap. Every time you blink theyre logging it. This is the end of financial privacy. And they call it progressRakesh Kumar January 24 2026

In India we're still waiting for clarity but I see the same pattern everywhere - when money gets involved, the state shows up. The real question isn't if regulation will win - it's whether we can build tools that work within it without losing the soul of crypto.Michael Gradwell January 25 2026

You people are naive. This isn't about crime. It's about control. They want to know who you are, where you are, and what you bought with your crypto. They don't care if you're clean. They care that you're traceable.Flannery Smail January 25 2026

The Travel Rule is just a tax collection tool dressed up as anti-crime tech. You think they care about ransomware? Nah. They care about unreported capital gains.Emmanuel Sadi January 26 2026

You think this is bad? Wait till CARF drops. Then every transaction gets reported to your local tax office. You're not a crypto user anymore. You're a data point. And your wallet? Just a spreadsheet with a private key.Nicholas Carpenter January 27 2026

I used to hate this stuff. But after seeing how many scams got shut down because someone traced a transaction? I’m not mad anymore. It’s not ideal. But it’s better than the chaos we had before.Tony Smith January 28 2026

Let us not overlook the fundamental truth: the architecture of trust in financial systems is being redefined, not dismantled. While the regulatory burden is substantial, the institutional adoption that follows - the liquidity, the infrastructure, the legitimacy - is not merely incidental. It is inevitable. The question is not whether we shall adapt, but whether we shall lead or merely follow.