Key Takeaways

- A block reward is the newly minted Bitcoin a miner receives for adding a valid block to the blockchain.

- The reward started at 50BTC in 2009 and halves roughly every four years, currently standing at 6.25BTC (as of 2025).

- Block rewards drive Bitcoin’s inflation schedule and secure the network, but they will disappear around 2140, leaving transaction fees as the sole incentive.

- Each halving reduces miners’ revenue, influencing hardware investment, electricity consumption, and Bitcoin’s price dynamics.

- Understanding the reward schedule helps investors, developers, and casual users gauge Bitcoin’s long‑term scarcity.

When people hear the term Bitcoin block reward, they often picture a sudden cash windfall. In reality, it’s a carefully programmed part of Bitcoin’s monetary policy that shapes everything from mining economics to the total supply of the currency.

Block reward is the amount of newly created Bitcoin awarded to the miner who successfully solves a proof‑of‑work puzzle and appends a new block to the blockchain. It is the primary way new BTC enter circulation.

Bitcoin is a decentralized digital currency that uses a peer‑to‑peer network and cryptographic proof‑of‑work to secure transactions. It was launched in 2009 by an anonymous creator known as Satoshi Nakamoto.

How the Block Reward Is Created

Every time a miner finds a valid hash that meets the current difficulty target, the protocol automatically inserts a special transaction called the coinbase transaction into the block. This transaction does not reference any previous inputs; instead, it creates the reward out of thin air.

The coinbase transaction can also include any transaction fee that users attached to the transactions inside the block. Fees are summed and added to the reward, giving miners a dual source of income.

Reward Schedule and Halving Events

The reward is not static. Satoshi designed a diminishing schedule to mimic the scarcity of precious metals. Roughly every 210,000 blocks-about four years-a halving occurs, cutting the block reward in half.

Below is the historical and projected reward timeline:

| Halving # | Block Height | Reward (BTC) | Year (Approx.) | Total BTC Minted After Halving |

|---|---|---|---|---|

| 0 (Genesis) | 0‑209,999 | 50 | 2009‑2012 | 2,625,000 |

| 1 | 210,000‑419,999 | 25 | 2012‑2016 | 5,250,000 |

| 2 | 420,000‑629,999 | 12.5 | 2016‑2020 | 6,562,500 |

| 3 | 630,000‑839,999 | 6.25 | 2020‑2024 | 7,687,500 |

| 4 | 840,000‑1,049,999 | 3.125 | 2024‑2028 | 8,250,000 |

| 5 | 1,050,000‑1,259,999 | 1.5625 | 2028‑2032 | 8,531,250 |

| 6 | 1,260,000‑1,469,999 | 0.78125 | 2032‑2036 | 8,671,875 |

| 7 | 1,470,000‑1,679,999 | 0.390625 | 2036‑2040 | 8,742,188 |

| … | … | … | … | … (approaches 21,000,000) |

The schedule ensures that the total supply will never exceed 21 million BTC, the hard cap embedded in the protocol.

Why the Reward Matters for the Network

The block reward serves two crucial roles:

- Economic incentive: Mining hardware and electricity cost billions of dollars every year. The reward (plus fees) offsets those expenses and motivates participants to keep the network running.

- Security mechanism: Proof‑of‑work requires miners to expend real energy. The higher the reward, the more hash power the network attracts, making attacks economically infeasible.

As the reward shrinks, miners increasingly rely on transaction fees for profit. This transition is central to Bitcoin’s long‑term sustainability plan.

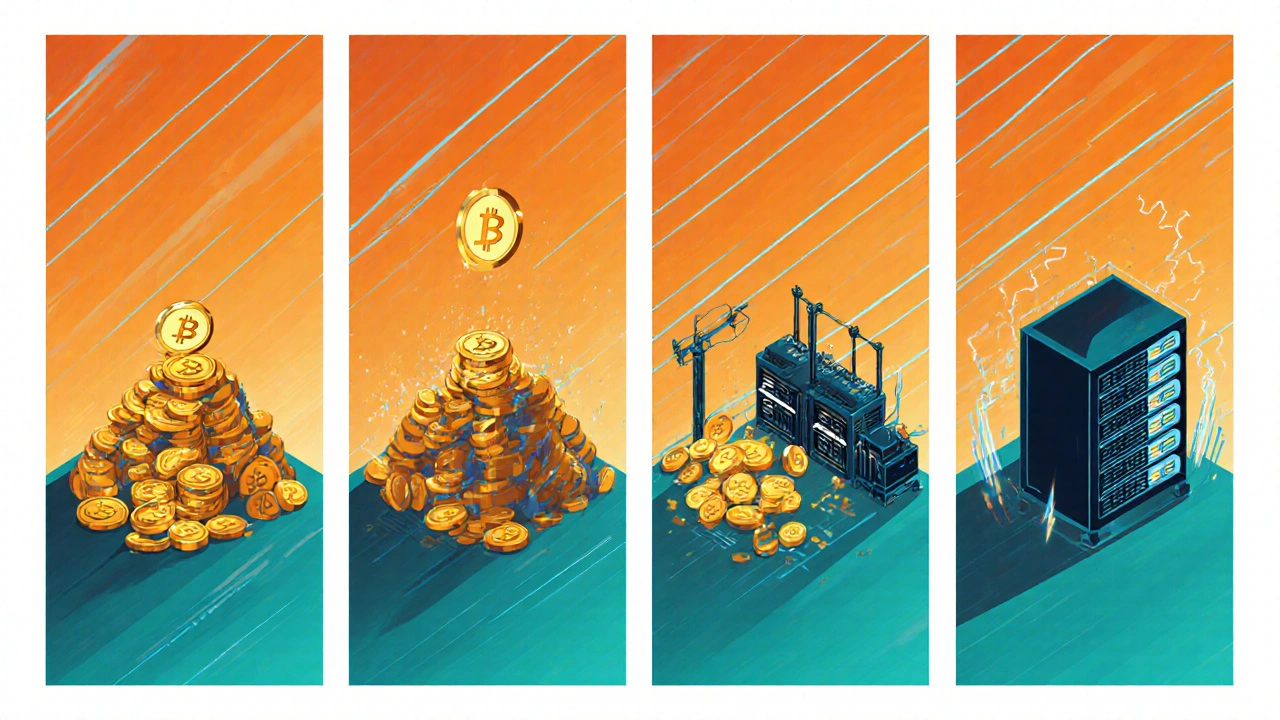

Impact on Miners and the Mining Industry

A halving is like a paycheck cut for every miner. Historical data shows that after each halving, there is a short‑term dip in hash‑rate as less efficient operators shut down. Over time, the network adjusts-newer, more efficient ASICs replace older machines, and the overall security level stabilises.

Because the reward is predictable, miners can model cash‑flow scenarios several years ahead. For example, after the 2024 halving, a miner with a 100TH/s rig earns roughly 0.0015BTC per day from the reward alone, plus whatever fees the block contains. Knowing the exact schedule helps them decide whether to invest in newer hardware or diversify into other cryptocurrencies.

Future Outlook: After the Last Bitcoin is Minted

By around the year 2140, the block reward will be effectively zero. At that point, the entirety of miners’ revenue will come from transaction fees. The protocol assumes that by then, the volume and value of Bitcoin transactions will be sufficient to sustain the required hash‑power.

Critics argue that fee‑only security is untested, while supporters point to the growing fee market in 2024‑2025 as evidence that users are already willing to pay higher fees for fast confirmations during peak demand.

Regardless of the outcome, the built‑in scarcity created by the reward schedule is what gives Bitcoin its "digital gold" narrative. Understanding the mechanics behind that scarcity is essential for anyone considering Bitcoin as a store of value, an investment, or a platform for building decentralized applications.

Practical Checklist for Anyone Dealing with Bitcoin Block Rewards

- Know the current reward (6.25BTC as of 2025) and the next halving estimate (around May2024, already passed; next one ~2028).

- Track the proportion of your mining income that comes from fees versus new BTC.

- Model cash‑flow over at least two halving cycles to gauge hardware ROI.

- Stay aware of network difficulty trends; a rising difficulty can erode profitability even if the reward stays constant.

- Consider the long‑term plan: after ~2140, will fee revenue sustain your operation?

Frequently Asked Questions

What exactly is a block reward?

A block reward is the amount of newly created Bitcoin that the miner who successfully appends a new block to the blockchain receives. It is generated by the special coinbase transaction inside each block.

How often does the block reward halve?

The reward halves every 210,000 blocks, which is roughly every four years. This event is known as the Bitcoin halving.

Why does Bitcoin have a maximum supply of 21 million?

The cap is hard‑coded into the protocol’s reward schedule. Because the reward shrinks by half roughly every four years, the total amount of BTC that can ever be created converges to 21million.

What happens to miners after the block reward disappears?

Miners will rely entirely on transaction fees for revenue. The network assumes that future transaction volumes and fee markets will be sufficient to keep miners incentivised.

How do transaction fees interact with the block reward?

Fees are added to the coinbase transaction along with the block reward, so a miner receives both the newly minted BTC and any fees attached to the transactions inside the block.

Can I predict the exact date of the next halving?

The date depends on block time, which averages 10 minutes but fluctuates. Forecasts use current block height and average block time to estimate the halving window, typically within a few weeks of the actual event.