Imagine your entire business depends on one client. One contract ends. One market crashes. One supplier fails. Suddenly, you’re staring at empty bank accounts and unpaid bills. That’s not a hypothetical. It’s what happened to dozens of small businesses in 2020 - and it’s still happening today. The truth? Relying on a single product, customer, or market is like walking a tightrope over a canyon with no safety net. The answer isn’t luck. It’s diversification strategy.

Why Diversification Isn’t Just for Big Companies

You might think diversification is something only Amazon or Apple does. But that’s not true. It’s a survival tactic - and it works whether you’re a one-person shop or a 50-person team. The data doesn’t lie: companies with three or more revenue streams saw 300% higher shareholder returns over the past decade than those stuck with just one. Why? Because when one part of your business dips, another can carry you. Take Sarah Mitchell, a London-based marketing consultant. In 2021, 80% of her income came from a single client. When that client cut budgets, her cash flow collapsed. She didn’t panic. She didn’t beg for more work. She started offering complementary services - social media training for small businesses, email automation setups, content audits. Within six months, she had 37 clients. Her biggest client now accounts for just 18% of revenue. Her business didn’t just survive - it became more stable, more predictable, more valuable. This isn’t about spreading yourself thin. It’s about building layers of resilience.The Four Types of Diversification (And Which One Works Best)

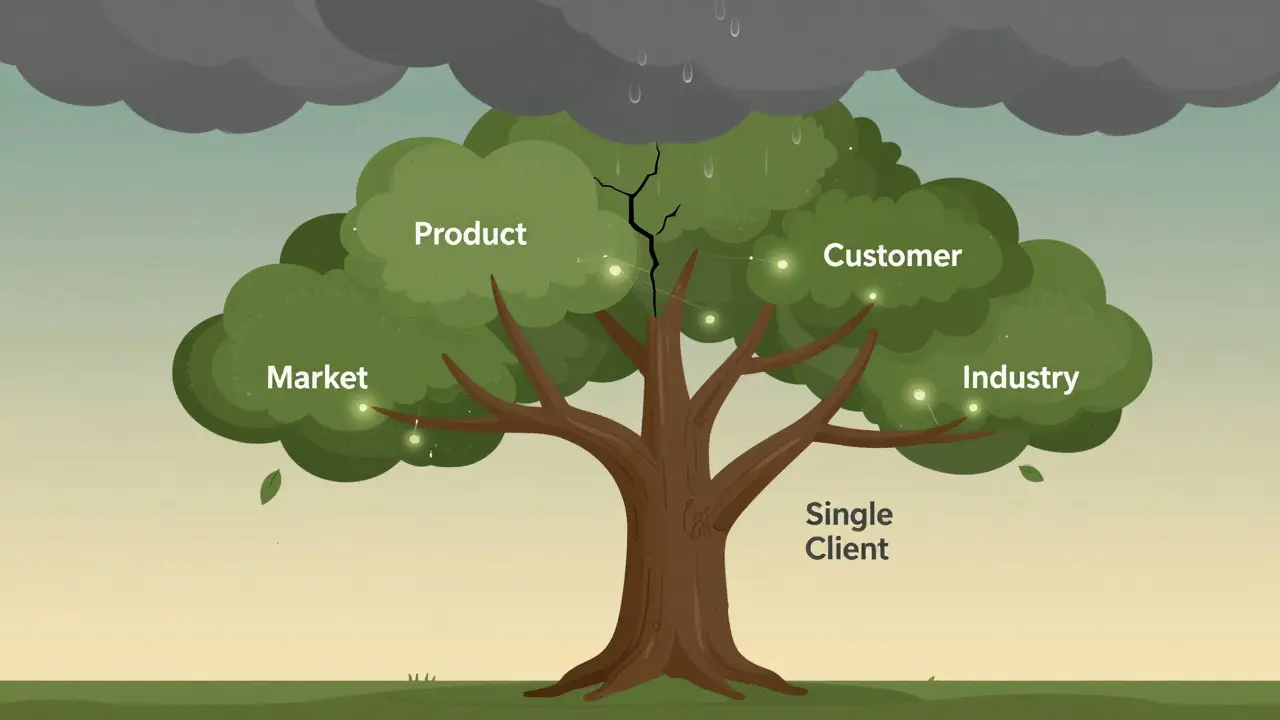

Not all diversification is created equal. There are four real ways to do it - and only one gives you the best shot at success.- Market diversification - Selling the same product in new places. Like a Scottish whisky brand expanding into Japan or Australia.

- Product diversification - Creating new products for your existing customers. Think of a coffee shop that starts selling artisanal pastries or reusable mugs.

- Customer diversification - Targeting new types of buyers. A B2B software company that starts selling to schools, nonprofits, or freelancers.

- Industry diversification - Entering a completely new field. Like a car parts manufacturer starting to make medical devices.

The 3-Part Rule for Smart Diversification

Park Avenue Capital found something powerful: the most successful diversifications share at least two of these three things with the core business:- Customer base - Are you serving the same people, just in a new way?

- Technology platform - Can you reuse your software, tools, or systems?

- Distribution channels - Can you sell it through your existing website, sales team, or partners?

What Happens When You Don’t Diversify

In 2020, travel agencies that only sold international flights lost 72% of their revenue. Those that added local tours, staycation packages, and virtual experiences kept 63% of their income. That’s the difference between survival and shutdown. The numbers are brutal: companies without diversified revenue streams are 3.2 times more likely to go bankrupt during economic downturns. And it’s not just recessions. Supply chain shocks, regulatory changes, tech disruptions - they all hit harder when you’re relying on one thing. A tech startup in Glasgow built a SaaS tool for accountants. It worked great - until HMRC changed reporting rules and 40% of their clients stopped using it. They had no backup. No Plan B. They shut down in nine months. Diversification isn’t optional anymore. It’s insurance.How to Start - Without Quitting Your Day Job

You don’t need a $1 million budget. You don’t need to hire a team of consultants. You just need to start small and test smart. Here’s a real 6-month plan that works:- Month 1-2: Audit your business - What do you already do well? Who are your best customers? What services do they ask for but you don’t offer?

- Month 3: Pick one adjacent opportunity - Not five. One. Something that uses your current skills or customers. Example: If you sell handmade soaps, start offering gift boxes for local businesses.

- Month 4: Test it cheaply - Launch a small version. Use Instagram. Offer it to 10 existing customers. Track what sells. What doesn’t.

- Month 5: Refine - Kill what doesn’t work. Double down on what does.

- Month 6: Scale - Add marketing, automate orders, maybe hire a part-time helper.

Common Mistakes (And How to Avoid Them)

Most diversification failures aren’t because the idea was bad. They’re because of these mistakes:- Doing it without research - 79% of failed attempts skipped market validation. Don’t assume people want your new product. Ask them.

- Spreading too thin - Trying to do three new things at once? You’ll burn out. Focus. One new stream at a time.

- Ignoring internal resistance - Your team might hate change. Create a small innovation team. Give them space to experiment without dragging down the rest of the business.

- Not tracking results - If you don’t measure revenue, profit, and time spent on each new stream, you’re flying blind.

What’s Next for Diversification?

AI is making this easier. Tools can now analyze customer behavior, spot emerging trends, and predict which new services will stick - all in days, not months. McKinsey predicts a 40% jump in diversification initiatives over the next three years because of this. The future belongs to businesses that don’t just sell products - they build ecosystems. Siemens doesn’t just sell industrial machines. It runs a platform where 17,000 developers build apps on top of its tech. That’s diversification without owning everything. That’s the next level. But you don’t need to be Siemens. You just need to be smarter than the business next door that’s still betting everything on one client, one product, one market.Final Thought: Resilience Is a Skill

Diversification isn’t a one-time project. It’s a habit. It’s checking your revenue sources every quarter. It’s asking, “What if this stops?” It’s being curious about what your customers need next. The most successful businesses aren’t the ones with the flashiest products. They’re the ones that never put all their eggs in one basket. Because when one basket breaks, they still have five others.Is diversification only for large companies?

No. Diversification works for businesses of any size. In fact, small businesses benefit the most because they’re more vulnerable to market shifts. A one-person consultant who adds three complementary services can reduce income risk by over 60%. The key isn’t scale - it’s strategy.

How many revenue streams should a business aim for?

Three to five is the sweet spot. Too few, and you’re still exposed. Too many, and you spread resources too thin. The goal is balance: enough variety to protect you, but not so much that you lose focus. Companies with 3-5 growing revenue streams see 300% higher returns than those with just one.

Can diversification hurt my brand?

Only if you do it randomly. Launching unrelated products - like a law firm selling fitness gear - confuses customers and weakens your identity. Smart diversification stays within your core strengths. A plumbing company adding water filtration systems? That makes sense. A plumbing company opening a gym? That doesn’t.

How long does it take to see results from diversification?

Real results take 6-12 months. You won’t see a surge in revenue overnight. But within 3-4 months, you should see early signs: customer interest, test sales, feedback. The key is patience and measurement. Track what works. Kill what doesn’t. Build slowly.

What’s the biggest mistake people make when diversifying?

Jumping into something completely new without testing it. Many businesses spend months and thousands of pounds launching a product they never validated with real customers. Always start small. Test with your existing audience. Get feedback before you invest heavily.

Should I diversify even if my business is doing well?

Yes - especially then. When things are going well, you have the resources and calm to plan wisely. Waiting until you’re in crisis means you’re forced to make desperate choices. The best time to diversify is when you don’t have to.

Comments (15)

Ronak Khandelwal December 20 2025

This hit me right in the soul 🌱 I was once that one-client consultant too. When they left, I thought it was the end. But I started teaching small biz owners how to use Canva for free - just 2 hours a week. Now it brings in 40% of my income. Diversification isn’t scary - it’s self-love in business form. You’re not spreading thin, you’re growing roots.Jeff Napier December 20 2025

Diversification is a scam pushed by consultants who sell courses. The real threat? Centralized AI-controlled banking systems that lock small biz out of credit. You think your 3 revenue streams matter when the Fed decides your PayPal account gets frozen for 'risk'? Wake up.Sibusiso Ernest Masilela December 21 2025

Oh please. You call this strategy? This is kindergarten-level survival advice wrapped in McKinsey jargon. Real diversification means owning land, gold, and a Swiss bank account. Not selling gift boxes while your business burns. If you’re still using Instagram to ‘test’ your future - you’re already dead.Daniel Kennedy December 21 2025

I’ve helped 12 small businesses pivot in the last 18 months. The magic isn’t in the new service - it’s in the mindset shift. You stop thinking ‘What do I sell?’ and start asking ‘Who do I serve?’ That’s when the opportunities appear. One guy turned his lawn care biz into a ‘neighborhood green space coach’ - now he’s booked 3 months out. No fancy tech. Just empathy.Taylor Hayes December 22 2025

I love how this breaks it down. The 3-part rule is gold. I run a small bookstore in Portland. We added local author readings - same customers, same space, same vibe. Then we started selling bookmarks made by local artists. Now 35% of our income comes from stuff we didn’t even think to offer two years ago. It’s not about reinventing - it’s about expanding the circle.Sanjay Mittal December 23 2025

In India, many small shops are doing this naturally. A tea stall starts selling packaged masala chai. A tailor adds embroidery repair. No big plan. Just listening. The article’s right - it’s not about scale. It’s about noticing what people ask for. Most entrepreneurs ignore those little requests. Big mistake.Mike Zhong December 24 2025

You’re all missing the point. Diversification is a symptom of capitalism’s decay. When you’re forced to create 3 revenue streams just to survive, it means the system is rigged. The real solution isn’t more services - it’s collective ownership, worker co-ops, and dismantling the profit-at-all-costs model. This article treats symptoms like solutions.Jamie Roman December 26 2025

I tried diversifying last year - added online coaching to my fitness studio. Took 8 months to get the first 5 clients. I almost quit. But I kept tracking: who showed up? What did they say? Turned out, my existing clients wanted ‘movement for anxiety’ sessions - not weight loss. So I pivoted. Now that stream brings in more than my in-person classes. It’s slow. It’s messy. But it works. Don’t rush it. Just show up.Salomi Cummingham December 28 2025

I cried reading Sarah’s story. Not because it’s inspiring - because it’s so painfully familiar. I lost 70% of my income in 2020. I didn’t have a plan. I didn’t have savings. I just sat on my floor for three days. Then I started posting daily on Instagram - not about my design work, but about my panic, my fears, my tiny wins. Strangers started DMing me: ‘Can you help me do this too?’ And that’s how my training program was born. It wasn’t strategy. It was vulnerability. And that’s what people paid for.Johnathan Rhyne December 28 2025

You say ‘related diversification’ like it’s some sacred law. But what’s ‘related’? A bakery selling candles? Sure, that’s weird. But what if those candles are made from spent coffee grounds from their own beans? Now it’s circular economy. What if the ‘law firm’ selling fitness gear is run by a former athlete who got disbarred and now teaches legal rights to athletes? Context matters. Stop being so rigid. Life isn’t a PowerPoint slide.Jawaharlal Thota December 29 2025

I’ve seen this play out in small towns across Uttar Pradesh. A mechanic starts fixing smartphones because his customers keep asking. A tailor starts making masks during the pandemic. These aren’t ‘strategies’ - they’re survival instincts. The article overcomplicates it. You don’t need a 6-month plan. You need to listen. Ask your customers: ‘What else do you need?’ Then do it. Simple. No jargon. No consultants. Just human connection.Lauren Saunders December 29 2025

I’m sorry, but this feels like corporate fluff dressed up as wisdom. If your business is so fragile that you need ‘three revenue streams’ to survive, maybe you shouldn’t be in business at all. Real resilience is building something so valuable, so essential, that people will fight to keep you alive - not just add another service when the wind blows.sonny dirgantara December 31 2025

this is fire. i run a tiny print shop and started doing custom stickers for local bands. now they come to me for merch too. no big plan. just said yes when someone asked. now i make more off stickers than posters. lol.Gina Grub January 1 2026

Let’s be brutally honest - most ‘diversification’ is just desperate scrambling. And the 300% return stat? Cherry-picked. The real data shows 82% of small biz diversifications fail within 18 months. You’re not building resilience. You’re building a house of cards with extra layers. And when it collapses? You’re deeper in debt with more stress. Stop romanticizing hustle culture.Nathan Jimerson January 2 2026

I started my business during the pandemic. Had one client. Then another. Then I offered a free audit. 17 people said yes. 3 became paying customers for a new service. Now I have four streams. It didn’t take magic. It took showing up, being honest, and not giving up. You don’t need a plan. You just need to keep going.