When you buy cryptocurrency, you don’t just get a number in an app-you get control over digital assets that can vanish if you mess up the basics. And here’s the hard truth: if you don’t hold your own private keys, you don’t really own your crypto. That’s not a metaphor. It’s how the blockchain works. So where should you keep your coins? On an exchange? Or in your own wallet? The answer isn’t one-size-fits-all. But understanding the difference between self-custody and exchange storage could save you thousands-or your entire portfolio.

What Self-Custody Really Means

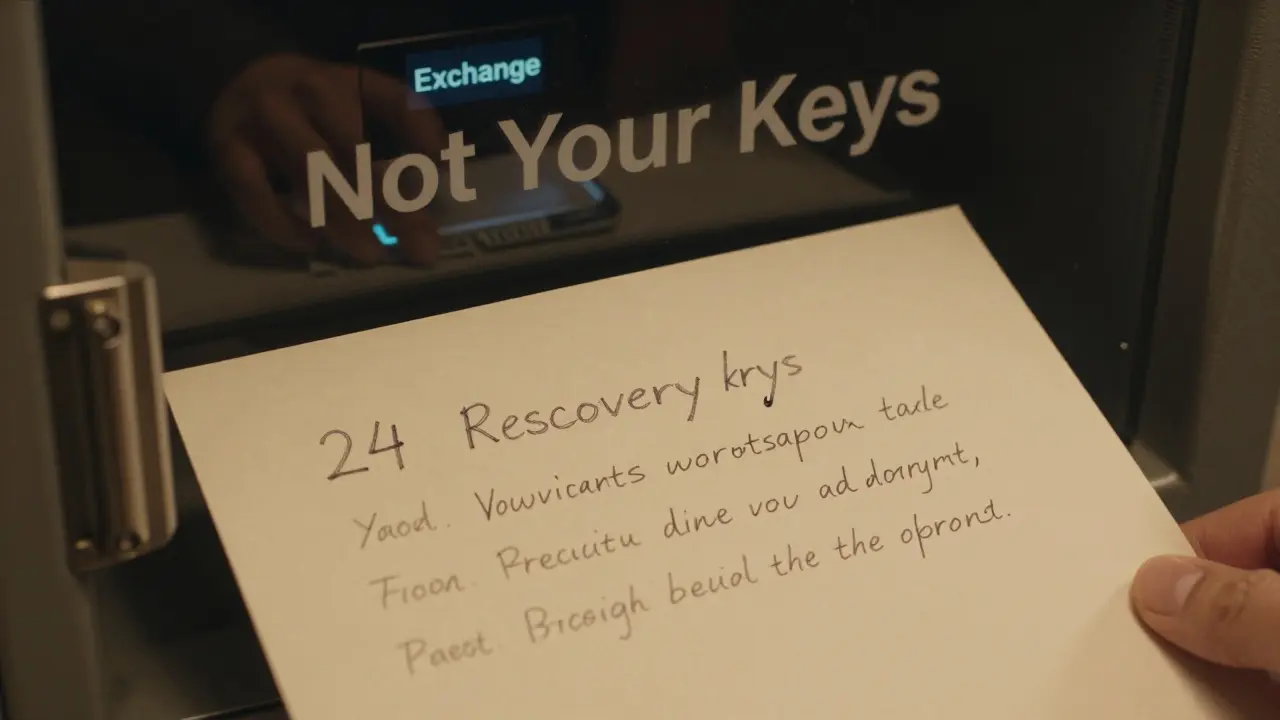

Self-custody means you, and only you, control the private keys that unlock your cryptocurrency. These keys are like the master password to your digital vault. No one else can access your funds-not even the company that sold you the wallet. You’re the sole guardian. That’s freedom. But it’s also responsibility. Most people start with hardware wallets like Ledger or Trezor. These are small devices, about the size of a USB stick, that store your keys offline. No internet connection means no hackers can reach them remotely. You connect it to your phone or computer only when you need to send or receive crypto. The real safety net? Your 12- or 24-word recovery phrase. Write it down on paper. Store it in a fireproof safe. Make two copies. Hide one in a different city. Lose it? Too bad. There’s no "forgot password" button on the blockchain. Your coins are gone forever. And yes, that sounds scary. But here’s the flip side: exchanges get hacked. All the time.Why Exchange Wallets Are a Risk

When you leave crypto on Binance, Coinbase, or Kraken, you’re not storing it-you’re lending it. The exchange holds your keys. They control your funds. And while they promise insurance, security teams, and multi-factor authentication, they’re still centralized targets. Think about Mt. Gox. Or FTX. Or Coincheck. All of them were top-tier exchanges. All of them collapsed. Billions in user funds vanished. Not because of individual user error. Because the exchange failed. And when an exchange goes under, you’re just another creditor. You don’t get your coins back. You get a line in a bankruptcy court. Even if the exchange doesn’t collapse, they can freeze your account. Maybe you triggered a compliance flag. Maybe regulators pressured them. Maybe they just decided to pause withdrawals during a market crash. That’s legal. That’s standard. And if you need cash fast? Tough luck. Exchanges also charge fees every time you withdraw. Sometimes $10, sometimes more. That adds up. Especially if you’re trading regularly. With self-custody, you pay network fees directly to miners or validators-often less than $1 on blockchains like Solana or Polygon. You’re not paying the middleman.The Security Trade-Off

Self-custody puts the burden of security on you. That means:- Backing up your seed phrase correctly (on paper, not in a photo or cloud note)

- Using a hardware wallet for anything over $1,000

- Never typing your recovery phrase into a website

- Keeping your device free of malware

- Knowing how to send transactions without sending to the wrong address

Who Should Use Self-Custody?

If you’re holding crypto for more than a few months-if you believe in its long-term value-self-custody is the only smart choice. This isn’t speculation. It’s basic risk management. The longer you plan to hold, the more you need to eliminate counterparty risk. Think about it: if you had $50,000 in Bitcoin, would you leave it on an exchange? Or would you lock it in a hardware wallet, buried in a safe, with a backup in a safety deposit box? The answer should be obvious. Most serious investors already do this. They call it "HODLing"-but the real secret is in the custody. Self-custody also gives you access to DeFi, NFTs, and other blockchain applications without needing permission. You can lend, borrow, stake, or trade directly on decentralized platforms. Exchanges block most of that. They want you to trade, not build.Who Should Stick With Exchanges?

If you’re actively trading-buying and selling daily, chasing short-term swings-then keeping a small portion on an exchange makes sense. You need liquidity. You need fast trades. You don’t want to wait 10 minutes for a transaction to confirm every time you want to cash out. But even then, keep it small. Maybe 5-10% of your total portfolio. Enough to trade, not enough to lose. The rest? Move it to your own wallet. Beginners, too, might start on an exchange. It’s easier. But don’t stay there. Use it as a bridge, not a home. Learn how to send a transaction. Practice with $10. Then move it off. You’ll be surprised how fast the process becomes second nature.

The Hybrid Strategy That Works

The smartest approach isn’t all-or-nothing. It’s layered:- Keep 5-10% of your crypto on a reputable exchange for active trading.

- Store 80-90% in a hardware wallet (cold storage).

- Write down your recovery phrase. Keep copies in sealed envelopes. Store one in a bank vault, one at a trusted friend’s house.

- Never store your seed phrase on your phone, cloud, or email.

- Use a password manager for exchange logins-but never for wallet keys.

Why This Matters More Than Ever

In 2026, crypto isn’t just a gamble. It’s becoming real money. People use it to pay rent in some countries. Businesses accept it for invoices. Governments are testing digital currencies. And if you’re holding crypto as a store of value, you need to treat it like gold-not like a stock tip. Gold doesn’t sit on a brokerage account. It sits in a vault. Your crypto should be no different. The phrase "Not your keys, not your coins" isn’t a slogan. It’s a law of the blockchain. If you don’t control the keys, you don’t control the asset. And if you don’t control the asset, you’re just trusting someone else to do it right. And in finance, trust is the riskiest asset of all.What You Should Do Today

Here’s your action plan:- Check your exchange balances. How much are you leaving on platforms? If it’s more than $500, move the rest to a wallet.

- Buy a hardware wallet. Ledger Nano X or Trezor Model T cost under $150. That’s cheaper than a monthly exchange fee.

- Write your recovery phrase on paper. Double-check the spelling. Take a photo of the paper and store it encrypted on a USB drive you keep separate.

- Test a small transfer. Send $10 to your new wallet. Then send it back. Make sure you know how.

- Set a reminder: every 3 months, check your wallet balance and backup.

Is it safe to keep crypto on an exchange long-term?

No. Exchanges are high-value targets for hackers and regulators. Even the most secure platforms have been hacked or frozen user funds. Keeping crypto on an exchange long-term means you’re trusting a company to protect your assets-which is exactly what decentralized crypto was designed to avoid. Only keep what you’re actively trading. Move the rest to self-custody.

Can I recover my crypto if I lose my private key?

No. If you lose your private key or recovery phrase and don’t have a backup, your crypto is permanently lost. There is no customer support, no reset button, no way to recover it. That’s why writing down your recovery phrase and storing it securely is non-negotiable. Exchanges can help you if you forget your password. Wallets can’t help you if you lose your keys.

Do I need a hardware wallet to use self-custody?

Not technically, but it’s the only safe way for anything over $1,000. Software wallets on phones or computers are vulnerable to malware and hacking. Hardware wallets keep keys offline and require physical confirmation to send funds. For long-term storage, skipping a hardware wallet is like storing cash in a cardboard box. You can do it-but you shouldn’t.

Are self-custody wallets harder to use than exchanges?

At first, yes. Setting up a hardware wallet and writing down your recovery phrase takes 20 minutes. Sending your first transaction feels intimidating. But after doing it once, it’s easier than logging into an exchange. Most modern wallets have simple interfaces. The real challenge isn’t usability-it’s discipline. You have to be careful. Exchanges do the hard work for you. Self-custody puts the work on you.

What’s the best way to store my recovery phrase?

Write it on paper using a permanent marker. Store it in a fireproof safe. Make a second copy and give it to a trusted person in another city. Never store it digitally-not in a photo, not in a note app, not on a cloud drive. If it’s on a device, it can be hacked. Paper is the only truly secure option.

Can exchanges steal my crypto?

They can’t "steal" it in the traditional sense, but they can freeze it, delay withdrawals, or lose it if they go bankrupt. Since they hold the keys, they control the assets. If FTX collapses, your crypto on FTX becomes part of its bankruptcy estate. You’re not the owner-you’re a creditor. Self-custody removes that risk entirely.

Is self-custody only for tech experts?

No. You don’t need to be a programmer. You just need to follow basic steps: buy a hardware wallet, write down the recovery phrase, store it safely, and test a small transaction. Many non-tech users do this successfully. The barrier isn’t skill-it’s fear. Once you do it once, you’ll realize it’s simpler than managing your bank password.

Do self-custody wallets cost money?

Hardware wallets cost $50-$150 once. After that, there are no monthly fees. You only pay network fees when you send crypto-often less than $1. Exchanges charge withdrawal fees, trading fees, and sometimes inactivity fees. Over time, self-custody saves you hundreds, even thousands, in fees.