When you buy an altcoin, you’re not just betting on the tech or the team-you’re betting on its money. And that means understanding how new coins are created, when they hit the market, and how many will ever exist. Most people look at price charts. Smart investors look at emission schedules.

What Exactly Is an Emission Schedule?

An emission schedule is the rulebook a cryptocurrency uses to release new tokens into circulation. It’s not random. It’s coded into the blockchain. Some projects release coins slowly over 10 years. Others dump millions every month. This isn’t just technical jargon-it’s the heartbeat of the coin’s value.

Think of it like a factory making coins. The emission schedule tells you how many coins come off the line each day, how many are saved for later, and whether the factory will ever shut down. If too many coins flood the market too fast, the price crashes. If too few are released, demand can outstrip supply and push prices up. It’s supply and demand, but with code instead of human decisions.

Fixed vs. Dynamic Emission: Two Very Different Paths

Altcoins fall into two main camps: fixed supply and dynamic supply.

Fixed supply coins have a hard cap. Bitcoin is the classic example-only 21 million will ever exist. Projects like Convex follow this model too, with a maximum of 100 million tokens that unlock gradually. This creates predictability. Investors know exactly how many coins will be out there in 2030. That transparency builds trust.

Dynamic supply coins, on the other hand, change how many are created based on network activity. Some mint new tokens every time someone stakes or locks up coins. Others adjust emissions based on price or demand. This sounds flexible, but it’s risky. If demand drops and emissions keep rising, you get inflation-fast.

Take a yield farm that offers 500% APY. Sounds amazing. But if the project is spitting out 10,000 new tokens a day with no cap, those tokens will crash in value. You’re not earning returns-you’re just holding a balloon that’s about to pop.

Supply Metrics That Actually Matter

Don’t just look at the total supply. That number can be misleading. Two numbers tell the real story:

- Circulating supply: Coins already out in the wild and available to trade.

- Total supply: All coins that will ever exist, including those locked up or not yet released.

For example, a coin might have a total supply of 1 billion, but only 100 million are circulating. That means 900 million are still locked. If those 900 million unlock all at once? Price goes down. Fast.

That’s where vesting schedules come in.

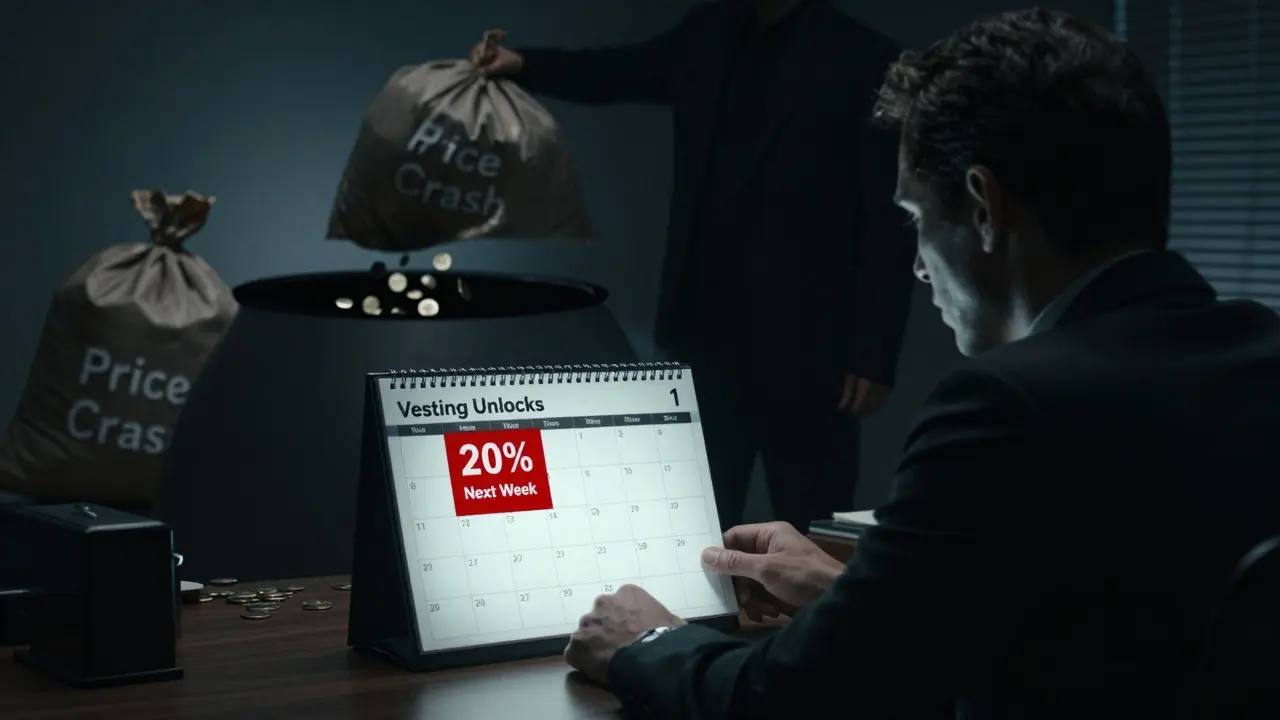

Vesting Schedules: The Silent Price Killer (or Savior)

Vesting schedules are time locks. They prevent early investors, founders, and venture capitalists from dumping their coins the second the coin launches.

Imagine a team gets 20% of all tokens. Without vesting, they could sell it all on day one and vanish. With vesting, those tokens unlock in chunks-say, 5% every six months over four years. That gives the project time to grow and gives the market time to absorb the supply.

But here’s the catch: every unlock is a potential sell-off. If the market is weak when a big unlock hits, the price can crash. That’s why smart investors check vesting calendars before buying. Sites like CoinMarketCap and Token Unlocks show when large blocks of coins are set to release. If a coin has 20% of its supply unlocking in one week? That’s a red flag.

And don’t forget Fully Diluted Valuation (FDV). It’s the market cap if every single token-even the locked ones-was traded today. If a coin has a $50 million market cap with 100 million circulating, but a total supply of 1 billion, its FDV is $500 million. That means 90% of its potential supply is still locked. If even 20% of that unlocks and demand doesn’t rise? Price dives.

Token Burns: The Anti-Inflation Tool

Some altcoins fight inflation by destroying coins. This is called burning. Binance does this with BNB-every quarter, it uses part of its profits to buy back and destroy BNB tokens. That reduces the total supply. Fewer coins + steady demand = higher price.

Ethereum took this further. After the Merge, it started burning more ETH than it issues in staking rewards. That made Ethereum deflationary-fewer coins in circulation over time. It’s rare, but powerful. Projects that burn tokens effectively are signaling they care about long-term scarcity.

But burning only works if the burn rate is high enough to offset new emissions. A coin that burns 1% a year but issues 5%? It’s still inflating. You need to do the math.

Staking Rewards and the Hidden Inflation Trap

Proof-of-Stake (PoS) coins pay you in new tokens just for holding and locking your coins. Sounds like free money. But those rewards are new coins being created. That’s inflation.

Here’s the twist: while staking rewards increase supply, they also lock up coins. So if 60% of all tokens are staked, the real circulating supply is lower than it looks. But if staking rewards drop? People unstake. More coins flood the market. Price drops.

That’s why some PoS coins have changing reward rates. They’re trying to balance between attracting stakers and avoiding too much inflation. It’s a tightrope walk.

Why Altcoins Crash Faster Than Bitcoin

Bitcoin has 19 million coins already out. Only 2 million left to mine over the next 120 years. That’s slow. Predictable. Quiet.

Altcoins? Many have 80% of their supply still to be released. And they release it fast. A coin might have 500 million tokens left to mine over five years. That’s 100 million a year. Or 8 million a month. That’s a flood.

Plus, altcoins have thinner markets. A $10 million coin with 100,000 in daily trading volume? One big unlock of 5 million coins can crash it. Bitcoin? It trades $20 billion a day. A few million coins moving won’t budge it.

And then there’s narrative. If AI tokens are hot, a coin with a bad emission schedule might still pump. But when the hype fades? The real numbers hit. Investors realize: “Wait, 70% of this supply unlocks next month.” Price collapses.

How to Check an Altcoin’s Emission Schedule

You don’t need to be a coder to check this. Here’s how:

- Go to the project’s official website or whitepaper. Look for “Tokenomics” or “Emission Schedule.”

- Find the total supply. Is it fixed? Unlimited?

- Check the circulating supply. How much is already out?

- Search for “vesting schedule” or “unlock schedule.” Use sites like Token Unlocks or CoinGecko.

- Look for burn mechanisms. Is there a quarterly burn? A deflationary fee?

- Calculate the emission rate: (Total Supply - Circulating Supply) / Years Left = Coins per year.

If the project doesn’t clearly state this? Walk away. No transparency = no trust.

The Future: More Automation, Less Guesswork

Smart contracts are making emission schedules more reliable. No more manual releases. No more broken promises. Everything is automatic. That’s a win.

Next-gen projects are tying emissions to real milestones: “10% unlocks when 1 million users join.” “5% burns when daily volume hits $50 million.” This links supply control to actual adoption-not just hype.

And more projects are going deflationary. Burning more than they mint. Making their coins scarcer over time. That’s the future. The coins that survive won’t be the ones with the flashiest marketing. They’ll be the ones with the cleanest, most predictable supply rules.

Final Rule: Scarcity Wins

Bitcoin’s value isn’t from being the first. It’s from being the most predictable. 21 million. No more. No less. That’s power.

Altcoins with unlimited supply? They’re gambling. Altcoins with 500 million tokens unlocking in 18 months? They’re setting themselves up to crash.

The best altcoins are the ones that feel like Bitcoin: limited, transparent, and slow. They don’t need to be flashy. They just need to be honest about how many coins they’ll ever make-and when they’ll release them.

What’s the difference between circulating supply and total supply?

Circulating supply is the number of coins currently available for trading. Total supply is the maximum number of coins that will ever exist-including those locked, reserved, or not yet released. A coin might have a total supply of 1 billion, but only 200 million circulating. That means 800 million are still locked up and will enter the market later.

Can an altcoin have no supply cap?

Yes. Some altcoins, especially stablecoins or utility tokens, have no maximum supply. They keep minting new coins as needed. This creates constant inflation. Without a cap, long-term value is harder to predict. Most serious investors avoid coins with unlimited supply unless there’s a strong deflationary mechanism like burning.

Do all staking rewards cause inflation?

Yes. Every staking reward is a newly minted coin. That increases the total supply. But if most holders are staking, those coins aren’t circulating yet. So the real inflation depends on how many coins are locked versus how many are actively traded. If staking rewards are high but staking rates are low, inflation hits fast.

How do token burns affect price?

Token burns reduce the total supply. If demand stays the same and fewer coins exist, each coin becomes more valuable. This is deflationary pressure. Ethereum’s burn mechanism has cut its supply growth to near zero. Coins that burn more than they emit can become scarcer over time-making them more attractive to long-term holders.

Why do vesting schedules matter for retail investors?

Vesting schedules tell you when big holders will sell. If a project’s team holds 15% of tokens and 10% unlocks next month, expect heavy selling pressure. Retail investors who buy before an unlock often get trapped. Checking unlock calendars helps avoid buying right before a price dump.

Are altcoins with fixed supply better than those with dynamic supply?

Generally, yes. Fixed supply creates predictability. Investors know exactly how many coins will exist in 5 or 10 years. Dynamic supply introduces uncertainty. Even if it sounds flexible, it often leads to uncontrolled inflation. Projects with fixed, transparent emission schedules tend to hold value better over time.

What’s a hyperinflation risk in altcoins?

Hyperinflation happens when new coins flood the market faster than demand can absorb them. This often occurs in yield farms that offer high APYs but mint thousands of new tokens daily. As more coins are released, each one becomes worth less. Eventually, the reward token crashes, and users lose money-even if they earned “high returns.”

Can an altcoin’s emission schedule change after launch?

Yes, but only if the project is governed by a DAO or has a central team with upgrade powers. Most blockchain projects can’t change their emission rules without community approval. However, some do-like Ethereum shifting from mining to staking and adding burns. Always check if the emission schedule is immutable or can be altered. Unchangeable rules = more trust.

Comments (11)

Ashley Kuehnel February 17 2026

Okay but like… I just bought some $SHIBA because my buddy said it was gonna moon, and now I’m realizing I have no clue what the emission schedule even is 😅. Is it just infinite? Are they burning anything? Someone please dumb it down for me. I’m a retail noob but I wanna learn.

adam smith February 18 2026

It is imperative to note that the emission schedule constitutes the foundational economic architecture of any cryptocurrency. Failure to comprehend this renders one susceptible to market manipulation and speculative folly.

Mongezi Mkhwanazi February 18 2026

Look, I’ve been in this space since 2017, and I’ve seen dozens of coins with ‘fixed supply’ turn out to be lies-because the dev team held 30% in a wallet with no vesting, then dumped it after 18 months. You think you’re safe because the whitepaper says ‘100M max’? Ha. Check the blockchain explorer. Look at the early whale addresses. If the top 10 wallets hold 40% of the total supply? It’s not scarcity-it’s a slow-motion pump-and-dump. And don’t even get me started on ‘token burns’-Binance burns BNB? Sure, but they also issue new BNB for their chain’s gas fees. Net effect? Zero. It’s theater. The only thing that matters is: who controls the minting key? And if the answer is ‘a DAO’? That’s just another word for ‘trust the devs’.

Mark Nitka February 20 2026

I get why people freak out about emissions, but let’s not pretend Bitcoin’s 21M cap is some divine truth. It was chosen arbitrarily. There’s no law of physics that says 21 million is optimal. What matters is adoption, utility, and network security-not some hardcoded number. Ethereum’s model is more realistic: it adjusts based on demand. If people want to use it, more ETH gets minted. If they don’t, emissions drop. That’s adaptive. Bitcoin’s just… frozen. And frankly, that’s why it’s stuck as digital gold, not digital money.

Kelley Nelson February 20 2026

How quaint. To assume that retail investors could possibly comprehend tokenomics without a degree in financial engineering. The notion that one could ‘check’ vesting schedules on CoinGecko is both endearing and tragically naive. The data is lagging. The APIs are unreliable. The ‘transparency’ you seek is a mirage constructed by marketing departments with PowerPoint slides and whitepapers written by interns. Real analysis requires access to on-chain data, node logs, and private team wallets-none of which are publicly available. Therefore, one must rely on… intuition. And perhaps, a therapist.

Aryan Gupta February 21 2026

EVERYTHING IS A SCAM. EVERY SINGLE COIN. The government, the Fed, the big banks-they all control the blockchain through the miners. The emission schedules? Fake. The burns? Just for show. They’re printing digital coins to fund their wars and buy politicians. And don’t tell me about ‘vesting schedules’-those are just the front for the real dump. I checked the genesis block of one altcoin and the first 1000 coins went to a wallet that was created 3 hours before the ICO. Coincidence? I think not. They’re all connected. You think you’re investing? You’re just funding the deep state. Wake up.

Fredda Freyer February 22 2026

What’s fascinating isn’t the math-it’s the psychology behind it. We’re conditioned to equate scarcity with value. But is that true? Water is abundant, yet essential. Gold is scarce, yet mostly decorative. Why do we assume a coin with a 10 million cap is ‘better’ than one with 10 billion? Maybe the 10 billion coin has 9.9 billion locked in staking, and only 100 million circulating-making it functionally scarcer. Or maybe the 10 million coin has 8 million pre-mined by devs. The numbers lie. The context tells the truth. And context? It’s messy. It’s human. It’s not in the smart contract. It’s in the community’s behavior, the team’s track record, the real-world use case. We treat crypto like a spreadsheet. But it’s a social experiment. And humans? They’re terrible at math. But brilliant at storytelling.

Gareth Hobbs February 22 2026

Britain had the gold standard. We built an empire on it. Now we’re letting Americans and Indians play with ‘altcoins’ that have more supply than a Walmart parking lot on Black Friday. It’s pathetic. And don’t even get me started on ‘token burns’-you think burning 1% of coins fixes anything? In my day, we didn’t need ‘burns’. We had discipline. We had restraint. We didn’t mint coins like they were TikTok memes. And why are all these projects so vague? Because they’re crooks. Every single one. The US is drowning in crypto fraud. And the UK? We’re too polite to call them out. But I will. It’s all a game. And you’re losing.

Zelda Breach February 22 2026

Wow. Someone actually wrote a 2000-word essay on emission schedules and called it ‘educational’. You forgot one thing: 90% of these altcoins are worthless because their devs are anonymous and their GitHub hasn’t been updated since 2021. If your ‘transparent’ tokenomics requires you to click 7 links, sign up for a newsletter, and download a PDF with 300 footnotes… it’s not transparent. It’s obfuscation. And if the team has a 20% allocation with a 4-year vesting? That’s not a ‘savior’-it’s a death sentence. Because when the last 5% unlocks in year 4? The price has already collapsed 95%. You didn’t invest. You just bought a tombstone.

Alan Crierie February 23 2026

Love this breakdown! 🙌 Especially the part about staking rewards being inflationary but also locking supply. That’s such a nuanced point most people miss. It’s like a sponge-some coins soak up liquidity, others just leak it. And the burn mechanism? Honestly, Ethereum’s model is the gold standard. Not because it’s perfect, but because it’s *adaptive*. It reacts. It doesn’t just sit there like a statue. That’s what real innovation looks like. Keep it real, keep it smart. 💪

Nicholas Zeitler February 24 2026

Just a quick note: if you’re checking emission schedules, don’t just look at the total supply-look at the *unlock timeline*. One coin I tracked had 1 billion total supply, but 600 million unlocked in a single month. Price dropped 70% in 48 hours. That’s not a ‘slow release’-that’s a grenade with the pin pulled. Always check the calendar. Use TokenUnlocks.com. Bookmark it. Set alerts. Your portfolio will thank you.